Wake County Property Tax Rate 2024 Calculation Table

Wake County Property Tax Rate 2024 Calculation Table – Wake County’s property tax rate for 2024 is .657 cents per $100 of property value, according to the country. The revenue neutral rate at the new appraisals would be .4643 cents per $100 of value. . Homeowners in multiple towns across Wake County could see their property rate for the 2024-25 fiscal budget until this summer when the budget process is complete. Based on a revenue-neutral .

Wake County Property Tax Rate 2024 Calculation Table

Source : www.wake.gov

Wake County, NC Property Tax Calculator SmartAsset

Source : smartasset.com

December 2023’s Median Price of Wake County Real Estate increased

Source : www.wake.gov

Sales taxes in the United States Wikipedia

Source : en.wikipedia.org

December 2023’s Median Price of Wake County Real Estate increased

Source : www.wake.gov

How To Charge Sales Tax in the US (2024) Shopify USA

Source : www.shopify.com

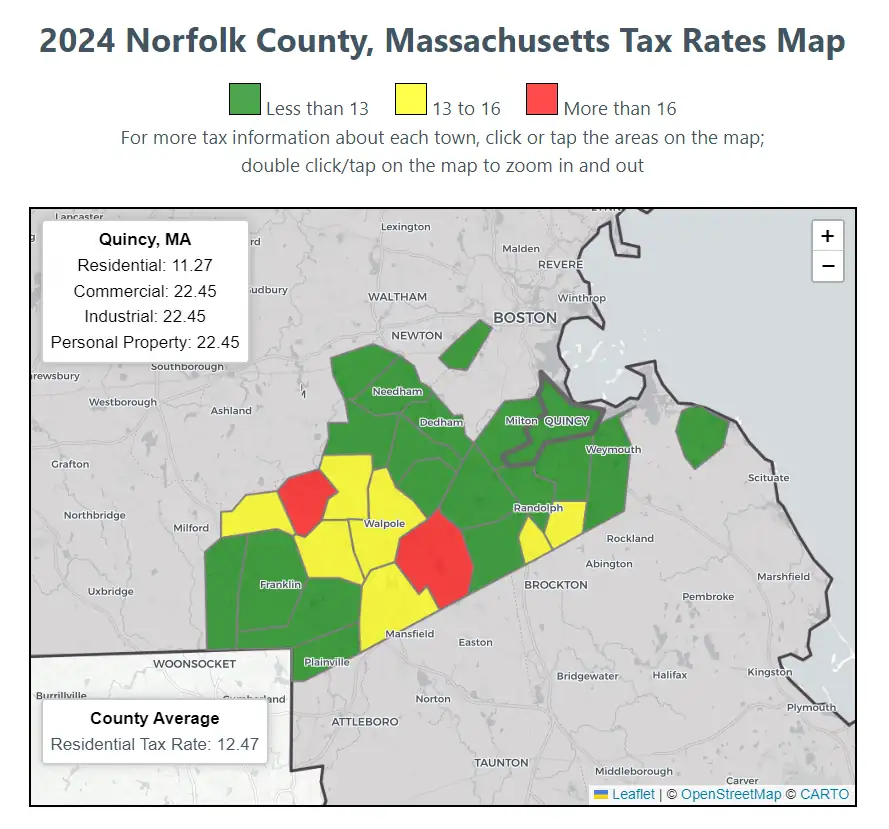

2024 Norfolk County Massachusetts Property Tax Rates | Residential

Source : joeshimkus.com

Sales taxes in the United States Wikipedia

Source : en.wikipedia.org

December 2023’s Median Price of Wake County Real Estate increased

Source : www.wake.gov

Art in the Park | Town of Wake Forest, NC

Source : www.wakeforestnc.gov

Wake County Property Tax Rate 2024 Calculation Table December 2023’s Median Price of Wake County Real Estate increased : While it’s very likely Wake County with a $1,176 property tax In 2024, it would be worth $300,000 with a $1,393 property tax In the same time, because of the lowering tax rate, tax bills . If you’ve got sticker shock after seeing your new Wake County property tax You can contact the tax administration to send a duplicate if you misplaced it. The mailing address is: Wake County Tax .